Dye production oligopoly, prices may start an upward trend

Release time:

2021-03-03

According to industry media reports, the price of disperse dyes surged on February 27, with all categories increasing by 5000 yuan/ton. The price of disperse black ECT 300% has reached 35000 yuan.

Industry insiders indicate that the current dye Price is relatively low. With the continuous increase in the Price of various chemical raw materials, the increase in orders from dyeing enterprises, and a positive future trend, dye Prices may start to rise. In addition, research by industry leaders Longsheng, RunTu, and JiHua shows that the current inventory level of disperse dyes is the lowest in the past three years.

Furthermore, stricter environmental protection and safety regulations have raised the entry barriers for dye manufacturers, eliminating the cost advantages of small dye manufacturers in environmental protection and safety, and restricting the overall supply of reactive dyes.

Dyes are substances that can dye fibers, fabrics, or other materials with vibrant and fast colors. According to the properties and application methods of dyes, they can be divided into subcategories such as disperse dyes, reactive dyes, sulfur dyes, reduction dyes, acid dyes, and direct dyes.

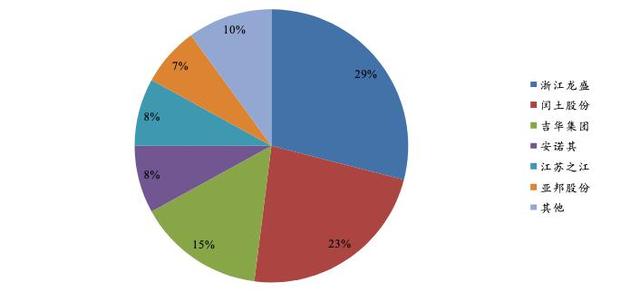

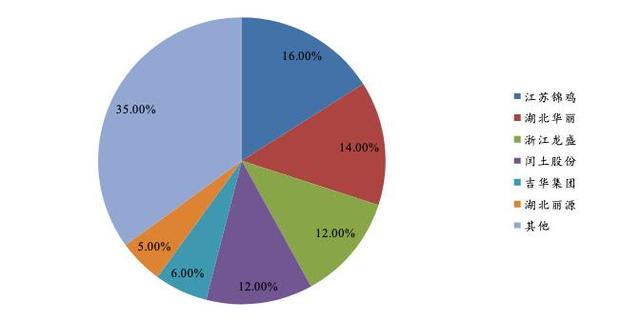

The current dye production pattern generally presents an oligopoly situation, with production capacity concentrated in a few companies. In 2019, China's disperse dye production capacity concentration CR5 was nearly 80%, while reactive dyes were relatively dispersed, with more small and medium-sized enterprises, and CR5 was 66%.

Disperse Dye Production Competitive Landscape:

Data Source: Zhongyuan Securities

Reactive Dye Production Competitive Landscape:

Data Source: Zhongyuan Securities

After the industry's supply-side reform and environmental inspections in 2017/18, the dye industry has formed a high concentration and a profit structure that is heavily weighted towards the upstream. With leading manufacturers controlling pricing power for dyes and dye intermediates, events such as environmental protection, maintenance, and business conditions can lead to high elasticity.

In 2019, the dye center was supported by the upward movement of upstream intermediate costs to a historical high. In 2019, global dye production was 790,000 tons, with disperse dyes, reactive dyes, and other dyes accounting for 338,000 tons, 221,000 tons, and 231,000 tons respectively, representing 43%, 28%, and 29%.

In 2020, the bottoming out of demand in the downstream textile and apparel industry dragged down the Price of dyes and dye intermediates.

Institutions believe that the turning point in the downstream textile and apparel industry + macroeconomic recovery will drive demand growth, and the support of dye intermediates remains, the industry chain will drive a new round of business conditions from the bottom up, and there is significant room for dye Price increases.

Comprehensively build a digital intelligent laboratory and a dyeing direct-through bridge technology

The great times need a grand vision, and a grand vision needs great responsibility. Recently, Guangdong Polytechnic jointly held a seminar on "Digital Intelligent Laboratory and Dyeing Direct-Through Car Bridge Technology Digital Solution" with Guangzhou Hongjing Lab Equipment Co., LTD, exploring the digital development of the printing and dyeing industry and solutions for dyeing direct-through cars with printing and dyeing graduates. Striving to improve its technological advantages, promote the development of the digital intelligent dyeing and finishing industry, and drive the upgrading of the printing and dyeing industry chain.

On January 10, the 2022 version of OEKO-TEX ® Standard 100 was released, and the new version will come into effect on April 1, 2022.

Textile and apparel export orders have seen a significant drop in July.

Recent data released by the General Administration of Customs shows that clothing and textile exports both declined in July. In RMB terms, textile and clothing exports totaled 181.39 billion yuan, down 18.24% year-on-year and up 1.82% month-on-month, and down 4.21% compared to the same period in 2019; of which, textile exports totaled 75.06 billion yuan, down 33.73% year-on-year and down 6.90% month-on-month, but up 1.30% compared to the same period in 2019; clothing exports totaled 106.33 billion yuan, down 2.08% year-on-year and up 9.03% month-on-month, but down 7.76% compared to the same period in 2019.