Dye production oligopoly, prices may start an upward trend

Release time:

2021-03-03

According to industry media reports, the price of disperse dyes surged on February 27, with all categories increasing by 5000 yuan/ton. The price of disperse black ECT 300% has reached 35000 yuan.

Industry insiders indicate that the current dye Price is relatively low. With the continuous increase in the Price of various chemical raw materials, the increase in orders from dyeing enterprises, and a positive future trend, dye Prices may start to rise. In addition, research by industry leaders Longsheng, RunTu, and JiHua shows that the current inventory level of disperse dyes is the lowest in the past three years.

Furthermore, stricter environmental protection and safety regulations have raised the entry barriers for dye manufacturers, eliminating the cost advantages of small dye manufacturers in environmental protection and safety, and restricting the overall supply of reactive dyes.

Dyes are substances that can dye fibers, fabrics, or other materials with vibrant and fast colors. According to the properties and application methods of dyes, they can be divided into subcategories such as disperse dyes, reactive dyes, sulfur dyes, reduction dyes, acid dyes, and direct dyes.

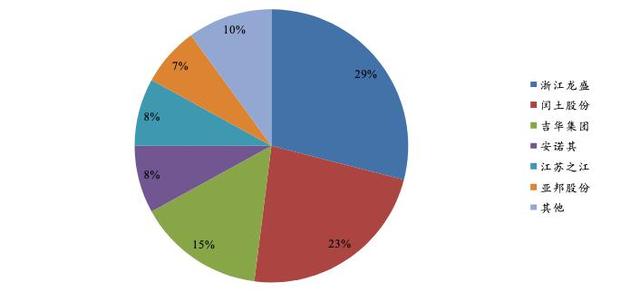

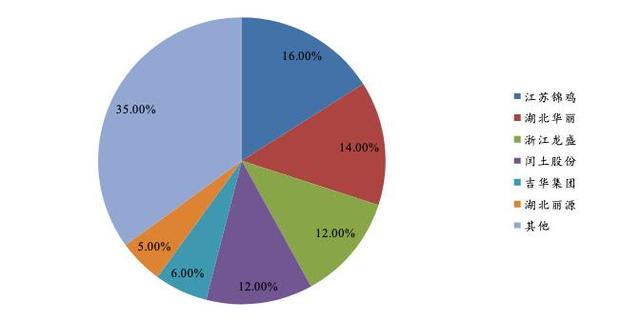

The current dye production pattern generally presents an oligopoly situation, with production capacity concentrated in a few companies. In 2019, China's disperse dye production capacity concentration CR5 was nearly 80%, while reactive dyes were relatively dispersed, with more small and medium-sized enterprises, and CR5 was 66%.

Disperse Dye Production Competitive Landscape:

Data Source: Zhongyuan Securities

Reactive Dye Production Competitive Landscape:

Data Source: Zhongyuan Securities

After the industry's supply-side reform and environmental inspections in 2017/18, the dye industry has formed a high concentration and a profit structure that is heavily weighted towards the upstream. With leading manufacturers controlling pricing power for dyes and dye intermediates, events such as environmental protection, maintenance, and business conditions can lead to high elasticity.

In 2019, the dye center was supported by the upward movement of upstream intermediate costs to a historical high. In 2019, global dye production was 790,000 tons, with disperse dyes, reactive dyes, and other dyes accounting for 338,000 tons, 221,000 tons, and 231,000 tons respectively, representing 43%, 28%, and 29%.

In 2020, the bottoming out of demand in the downstream textile and apparel industry dragged down the Price of dyes and dye intermediates.

Institutions believe that the turning point in the downstream textile and apparel industry + macroeconomic recovery will drive demand growth, and the support of dye intermediates remains, the industry chain will drive a new round of business conditions from the bottom up, and there is significant room for dye Price increases.

In June 2021, China's textile and apparel exports totaled US$125.153 billion

According to customs statistics, in June 2021, China's exports of textile yarn, fabrics, and made-up articles totaled US$12.5153 billion; from January to June 2021, China's exports of textile yarn, fabrics, and made-up articles totaled US$68.558 billion, a year-on-year decrease of 7.4%; from January to June 2020, China's exports of textile yarn, fabrics, and made-up articles totaled US$74.0173 billion.

Driven by the sustained recovery of domestic and international market demand, the economic operation of China's dyeing industry has further consolidated its recovery trend. From January to May, the output of dyed fabrics has significantly increased compared to the pre-epidemic period, and the industry's operational efficiency has accelerated its recovery. Exports continue to grow, but the trend of "increasing volume but falling prices" has yet to be reversed, and the industry still faces considerable competitive pressure in exports.

The "Belt and Road" initiative unlocks new opportunities for China's industrial textile market

In recent years, with the rapid economic development of countries and regions along the Belt and Road Initiative, such as Southeast Asia and Africa, and the moderate growth in demand from traditional markets such as Europe, America, Japan, and South Korea, overall market demand will be further released, providing Chinese enterprises with further opportunities to expand market space and creating favorable market conditions for the development of China's industrial textile industry.

Riding the wave of national trends, leading domestic textile and apparel brands benefit

Population iteration and Gen Z-led consumption are the main forces driving the rise and evolution of the national trend. From the supply side, leading domestic brands have been steadily improving their internal capabilities in recent years, narrowing the gap with their overseas competitors in brand building, retail operations, supply chain capabilities, and digital system construction, and continuously adapting to and leading the deepening of the national trend.