Dyeing and printing cloth output increased from January to May, but the trend of increasing volume and decreasing price in exports has not yet been reversed.

Release time:

2021-07-14

In May 2021, driven by the continuous recovery of domestic and international market demand, the economic operation of China's dyeing industry further consolidated its recovery trend. From January to May, the scale of dyed fabric production increased significantly compared to the pre-epidemic period, the industry's operational efficiency accelerated its recovery, and exports continued to grow. However, the trend of "increased volume but decreased price" has not yet been reversed, and the industry's exports still face considerable competitive pressure.

Production Continues to Maintain a Relatively Fast Growth Trend

According to data from the National Bureau of Statistics, from January to May 2021, the output of dyed fabrics by large-scale dyeing enterprises reached 22.712 billion meters, a significant year-on-year increase of 27.55%, and a 15.47% increase compared to the same period in 2019. Since 2021, with the gradual easing of domestic and international supply and demand contradictions, the production situation of China's dyeing industry has been positive, and the monthly output of dyed fabrics in the first five months has remained above 5 billion meters. From the perspective of domestic sales, from January to May, the retail sales of high-limit clothing, shoes, hats, and textiles in China increased by 39.1% year-on-year; from the perspective of exports, from January to May, China's total export value of textile and garment products increased by 17.3% year-on-year, with clothing exports increasing significantly by 48.3% year-on-year. With the gradual recovery of domestic and international consumer demand for textile and garment products, the dyeing industry has achieved relatively fast growth.

Operating Quality Continues to Improve, and Enterprise Capital Turnover Pressure Eases

According to data from the National Bureau of Statistics, from January to May 2021, the three-expense ratio of large-scale dyeing enterprises was 7.14%, a year-on-year decrease of 0.14 percentage points, of which cotton dyeing enterprises were 6.84% and chemical fiber dyeing enterprises were 9.23%; the finished product turnover rate was 7.63 times/year, a year-on-year increase of 19.72%; the accounts receivable turnover rate was 3.58 times/year, a year-on-year increase of 15.28%; and the total asset turnover rate was 0.41 times/year, a year-on-year increase of 16.32%. Compared with the same period in 2019, from January to May 2021, the three-expense ratio of large-scale dyeing enterprises increased by 0.29 percentage points, the finished product turnover rate decreased by 13.74%, the accounts receivable turnover rate increased by 5.25%, and the total asset turnover rate decreased by 9.39%. Although the finished product turnover rate and total asset turnover rate are still significantly different from the pre-epidemic period, they generally show a recovery trend. The accounts receivable turnover rate achieved positive growth for the first time compared to the same period in 2019, indicating that as enterprises gradually return to normal production and operation, the pressure on enterprise capital turnover is also gradually alleviated.

Table 1: Main Operating Indicators of Large-Scale Dyeing Enterprises in January-May 2021

Economic Efficiency Accelerates Repair

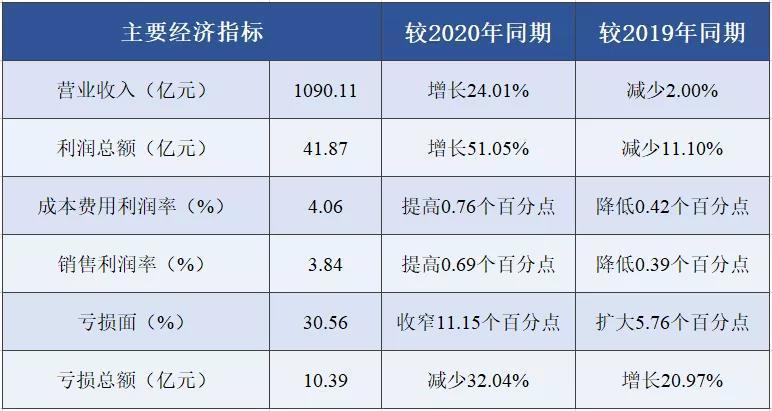

From January to May 2021, the operating income of large-scale dyeing enterprises was 109.011 billion yuan, a year-on-year increase of 24.01%, exceeding the growth rate of the entire textile industry by 3.21 percentage points; the operating cost was 95.372 billion yuan, a year-on-year increase of 22.99%, accounting for 87.49% of operating revenue; the total profit reached 4.187 billion yuan, a significant year-on-year increase of 51.05%; the cost-expense profit margin was 4.06%, a year-on-year increase of 0.76 percentage points; the sales profit margin was 3.84%, a year-on-year increase of 0.69 percentage points; and the export delivery value reached 14.799 billion yuan, a year-on-year increase of 17.62%. Compared with the same period in 2019, from January to May 2021, the operating income of large-scale dyeing enterprises decreased by 2.00%, the total profit decreased by 11.10%, the cost-expense profit margin decreased by 0.42 percentage points, the sales profit margin decreased by 0.39 percentage points, and the export delivery value decreased by 10.85%.

Among the 1,548 large-scale dyeing enterprises, 473 enterprises suffered losses, with a loss rate of 30.56%, a year-on-year decrease of 11.15 percentage points, and an increase of 5.76 percentage points compared to the same period in 2019; the total losses of loss-making enterprises amounted to 1.039 billion yuan, a year-on-year decrease of 32.04%, and an increase of 20.97% compared to the same period in 2019.

Compared with January-April, from January to May, the year-on-year growth rates of operating income and total profit of large-scale dyeing enterprises increased by 2.48 and 7.44 percentage points respectively, the sales profit margin increased by 0.25 percentage points, and the loss rate decreased by 1.63 percentage points, indicating that the profitability of enterprises is accelerating its recovery.

Table 2: Main Economic Indicators of Large-Scale Dyeing Enterprises in January-May 2021

Exports Continue to Grow, but the Trend of "Increased Volume, Decreased Price" Remains Unchanged

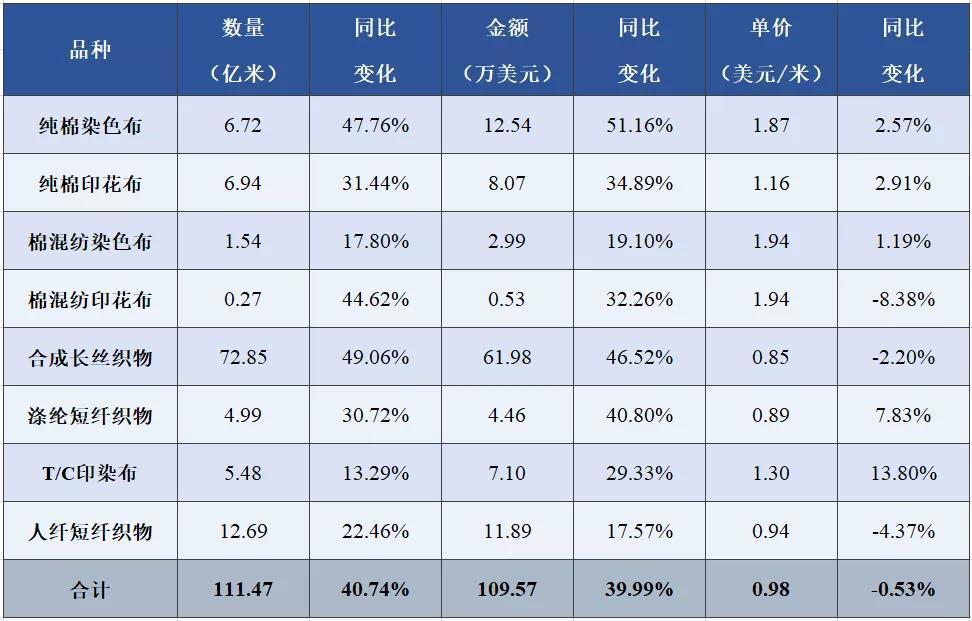

According to data from the General Administration of Customs of China, from January to May 2021, the export volume of eight major categories of dyed products reached 11.147 billion meters, a year-on-year increase of 40.74%; the export value was US$10.957 billion, a year-on-year increase of 39.39%; and the average export unit price was US$0.98/meter, a year-on-year decrease of 0.53%. Compared with the same period in 2019, the growth rates of export volume, export value, and average export unit price were 3.63%, -1.36%, and -4.81% respectively. In the first five months of 2021, the export volume of eight major categories of dyed products achieved positive growth compared to the same period in 2019, but the growth rate of export value fluctuated, and the average export unit price showed negative growth, indicating that the trend of "increased volume but decreased price" in the industry has not yet been reversed, and the competition in the export market of dyed fabrics is fierce.

Overall, since 2021, China's dyeing industry has gradually emerged from the impact of the epidemic, achieving continuous recovery. Various economic indicators have shown significant improvement compared to the previous year, and the foundation for the stable development of the industry has been continuously consolidated. It is expected that the dyeing industry will continue its recovery trend in the second half of the year. In the recovery process, industry enterprises should strengthen technological innovation and product development, effectively transform the industry's development mode, and promote the transformation of the industry from scale advantage to quality and efficiency.

Comprehensively build a digital intelligent laboratory and a dyeing direct-through bridge technology

The great times need a grand vision, and a grand vision needs great responsibility. Recently, Guangdong Polytechnic jointly held a seminar on "Digital Intelligent Laboratory and Dyeing Direct-Through Car Bridge Technology Digital Solution" with Guangzhou Hongjing Lab Equipment Co., LTD, exploring the digital development of the printing and dyeing industry and solutions for dyeing direct-through cars with printing and dyeing graduates. Striving to improve its technological advantages, promote the development of the digital intelligent dyeing and finishing industry, and drive the upgrading of the printing and dyeing industry chain.

On January 10, the 2022 version of OEKO-TEX ® Standard 100 was released, and the new version will come into effect on April 1, 2022.

Textile and apparel export orders have seen a significant drop in July.

Recent data released by the General Administration of Customs shows that clothing and textile exports both declined in July. In RMB terms, textile and clothing exports totaled 181.39 billion yuan, down 18.24% year-on-year and up 1.82% month-on-month, and down 4.21% compared to the same period in 2019; of which, textile exports totaled 75.06 billion yuan, down 33.73% year-on-year and down 6.90% month-on-month, but up 1.30% compared to the same period in 2019; clothing exports totaled 106.33 billion yuan, down 2.08% year-on-year and up 9.03% month-on-month, but down 7.76% compared to the same period in 2019.