China's textile and apparel exports in January-February totaled 301.36 billion yuan, up 44.7% (Table)

Release time:

2021-03-09

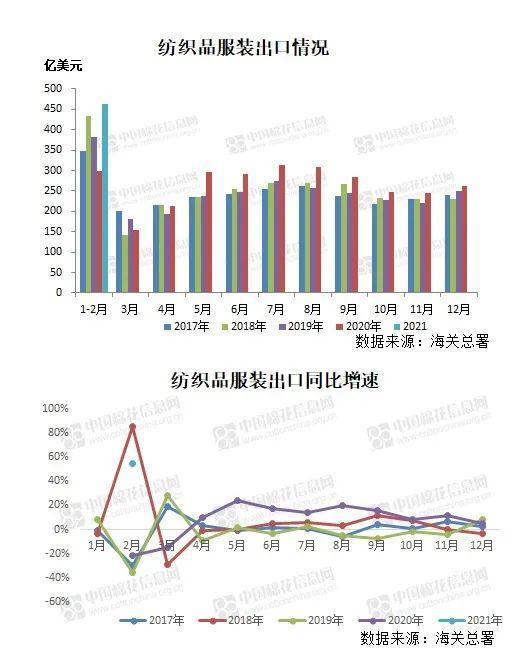

According to data released by China's General Administration of Customs on March 7, in the first two months of this year, against the backdrop of a low base effect caused by the epidemic in the same period last year, China's total goods trade exports and textile and apparel exports both achieved high-speed growth of over 40%.

Total value of national goods trade imports and exports in RMB: In the first two months of 2021, the total value of goods trade imports and exports was 5.44 trillion RMB, an increase of 32.2% year-on-year (the same below), of which exports were 3.05 trillion RMB, an increase of 50.1%, and imports were 2.38 trillion RMB, an increase of 14.5%.

Total value of national goods trade imports and exports in USD: In the first two months of 2021, the total value of goods trade imports and exports was US$834.49 billion, an increase of 41.2% year-on-year, of which exports were US$468.87 billion, an increase of 60.6%, and imports were US$365.62 billion, an increase of 22.2%.

Textile and apparel exports in RMB: In the first two months of 2021, the cumulative export of textiles and apparel was 301.36 billion RMB, an increase of 44.7%, of which textile exports were 144.44 billion RMB, an increase of 50.2%, and apparel exports were 156.92 billion RMB, an increase of 40.0%.

Textile and apparel exports in USD: In the first two months of 2021, the cumulative export of textiles and apparel was US$46.18 billion, an increase of 55.0%, of which textile exports were US$22.13 billion, an increase of 60.8%, and apparel exports were US$24.05 billion, an increase of 50.0%.

Note 1: The General Administration of Customs' statistics on textiles and apparel include: textile yarns, fabrics and products, clothing and clothing accessories. Note 2: The General Administration of Customs may adjust historical data; the above figures are calculated based on the latest data.

In June 2021, China's textile and apparel exports totaled US$125.153 billion

According to customs statistics, in June 2021, China's exports of textile yarn, fabrics, and made-up articles totaled US$12.5153 billion; from January to June 2021, China's exports of textile yarn, fabrics, and made-up articles totaled US$68.558 billion, a year-on-year decrease of 7.4%; from January to June 2020, China's exports of textile yarn, fabrics, and made-up articles totaled US$74.0173 billion.

Driven by the sustained recovery of domestic and international market demand, the economic operation of China's dyeing industry has further consolidated its recovery trend. From January to May, the output of dyed fabrics has significantly increased compared to the pre-epidemic period, and the industry's operational efficiency has accelerated its recovery. Exports continue to grow, but the trend of "increasing volume but falling prices" has yet to be reversed, and the industry still faces considerable competitive pressure in exports.

The "Belt and Road" initiative unlocks new opportunities for China's industrial textile market

In recent years, with the rapid economic development of countries and regions along the Belt and Road Initiative, such as Southeast Asia and Africa, and the moderate growth in demand from traditional markets such as Europe, America, Japan, and South Korea, overall market demand will be further released, providing Chinese enterprises with further opportunities to expand market space and creating favorable market conditions for the development of China's industrial textile industry.

Riding the wave of national trends, leading domestic textile and apparel brands benefit

Population iteration and Gen Z-led consumption are the main forces driving the rise and evolution of the national trend. From the supply side, leading domestic brands have been steadily improving their internal capabilities in recent years, narrowing the gap with their overseas competitors in brand building, retail operations, supply chain capabilities, and digital system construction, and continuously adapting to and leading the deepening of the national trend.